Product-to-platform part VII: Corning’s Gorilla Glass

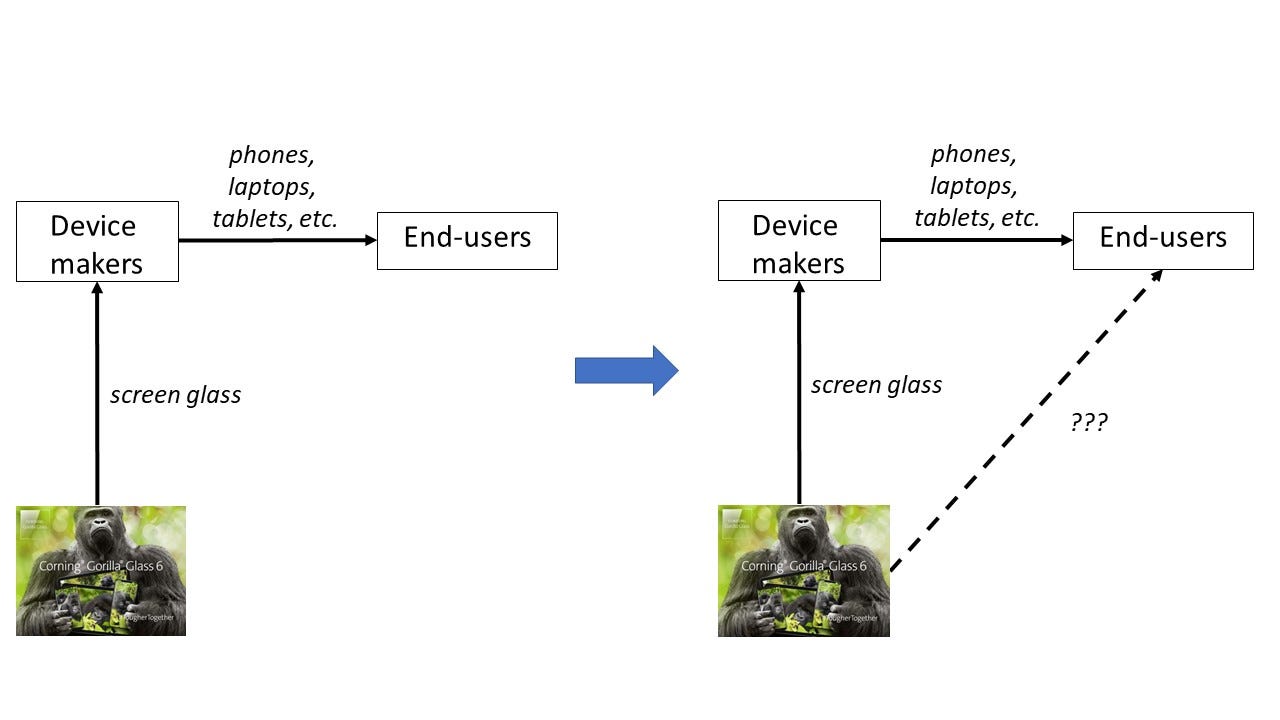

How can Corning’s Gorilla Glass be transformed into a platform by reaching out to its customers’ customers?

This week we circle back to one of our favorite topics, product-to-platform. In particular, we discuss how Corning’s Gorilla Glass can be transformed into a platform using the method of reaching out to customers’ customers. Recall this means creating some sort of marketplace between its customers and its customers’ customers (e.g. Open Table, Shopify).

Why Corning’s Gorilla Glass? Because it is an industrial, non-digital and B2B product, which a priori would seem quite difficult to transform into a platform. That makes the exercise all the more interesting. And it is meant to illustrate the point that even non-digital and boring products can benefit from (partially) moving in the direction of platform businesses. The goal is not to become an Alibaba or an Amazon or a Facebook, but to increase defensibility and accelerate growth by incorporating some platform features.

Gorilla Glass?

Gorilla Glass is the best-known screen glass for laptops, tablets, smartphones, wearables, and other devices. In particular, its customers include Apple, Samsung, Acer, Dell, Lenovo, etc. These customers incorporate the Gorilla Glass in their devices, which they sell to end-users.

Interestingly enough, Corning has been advertising Gorilla Glass to end-users for years, even though it does not sell anything to them. Here are some examples:

In fact, one of us initially became aware of the Gorilla Glass after seeing its full-page ads in The Economist magazine. This is of course an example of ingredient branding, reminiscent of Intel’s classic “Intel Inside” marketing campaign.

Turning Gorilla Glass into a platform

So how can Gorilla Glass be turned into a (partial) platform?

The first method for doing so, opening the door to third-parties, seems quite limited in this case. There are no obvious complementary products or services to the Gorilla Glass that could be best supplied by 3rd-parties to Corning’s customers alongside the glass.

The second product-to-platform method, connecting customers, is arguably the least relevant here. It’s hard to think of any interactions/transactions between Corning’s customers (large OEMs) that would benefit from being mediated by the Gorilla Glass.

It’s the third method for turning products into platforms, reaching out to customers’ customers, that is most interesting here – and the primary reason we chose this example.

Note in particular that reaching out to customers’ customers is significantly more difficult for Corning than for other B2B products we have discussed (e.g. Shopify, Indigo Agriculture, Open Table, Teachable). This is for two main reasons:

As good as the Gorilla Glass is, it is not the most important component of the final product (smartphones, laptops). Nor is it a digital component that is a natural candidate to become a platform, like, say, an operating system or a microprocessor or a software tool that mediates the customers interactions with their customers (e.g. OpenTable, Shopify, Teachable).

Corning’s customers are very large companies (much larger than Corning), who would likely thwart any blatant attempt to take control of their customers via a broad-scope platform. Again, this is very different from Shopify, Indigo Agriculture, Open Table and Teachable, where customers were very small businesses or individuals.

One might ask whether the “Gorilla Glass” marketing campaign doesn’t by itself create a platform by reaching out to customers’ customers. The answer is not really. Ingredient branding can be very powerful in creating brand awareness in the eyes of end-customers, which then puts some pressure on Corning’s customers to include Gorilla Glass in their devices and possibly to pay a premium for it relative to alternatives. This undeniably creates some defensibility, but does not generate network effects.

Either way, we believe an “ingredient” supplier like Corning can go further in terms of reaching out to its customers’ customers. Specifically, Corning could prompt end-users to register their device featuring Gorilla Glass on its website or app, where they would 1) receive some credit or discount for buying other devices with Gorilla Glass, and 2) be able to browse and discover (and possibly purchase) such devices.

Two key points:

Only offering a monetary benefit (e.g. insurance or warranty for the glass) that covers the current product purchased by the end-user would not be enough. That would add value to the end-user and possibly allow Corning to extract some additional money from them, but would not create any network effects. It is indeed important that the monetary benefit comes from buying multiple products that feature Gorilla Glass, so that in a sense, the end-user adopts Gorilla Glass as they would adopt a platform.

Only having a website or app that lists devices featuring Gorilla Glass would not be enough either. This would simply be an extension of the “Gorilla Glass inside” marketing campaign – great for raising awareness and possibly getting customers to pay a premium for Corning’s products, but not really moving in the direction of a platform with network effects.

So does the proposal above create network effects? Yes: any device maker that chooses to rely on Gorilla Glass benefits when more end-users accept the Gorilla Glass offer, as they are more likely to find out about its products and might be more inclined to buy them given the financial reward from buying another device with Gorilla Glass. And conversely, end-users obviously are more likely to take the offer when there are more brands and devices that use Gorilla Glass.

As we’ve discussed in our post on reaching out to customers’ customers, the biggest challenge with this method for transforming products into platforms is overcoming potential resistance by the company’s customers. Would Apple, Samsung, Lenovo and other Corning customers resist the approach described above? We think it’s unlikely. As explained earlier, Corning offering end-users some credit or discount for buying other devices with Gorilla Glass can be argued to increase the sales of Corning’s customers. Of course, in theory, an individual customer like Apple could worry that Corning’s offer might make some Apple users more likely to consider competitors’ devices. However, we don’t think this would or should be a realistic source of concern: Corning’s customers are large companies with well-established brands, for whom the risk of commoditization by a possible Corning platform is minimal (by contrast with, for example, Shopify’s position vis-à-vis its small business customers).

Concluding thoughts

While our product-to-platform proposal is unlikely to turn Gorilla Glass into the screen tail that wags the smartphone dog, it would help enhance its defensibility and possibly accelerate sales growth. Furthermore, our proposal for Corning can be applied (with suitable adaptations) to any other component supplier or manufacturer, whether or not they have resorted to ingredient branding (e.g. Gore-Tex clothing technologies, NutraSweet’s sweeteners, Microban’s anti-microbial technologies, etc.).

Nice article. I have a query regarding "Corning could prompt end-users to register their device featuring Gorilla Glass on its website or app, where they would 1) receive some credit or discount for buying other devices with Gorilla Glass, and 2) be able to browse and discover (and possibly purchase) such devices" How will end users put pressure on OEMs to use Gorilla Glass on different devices that it will benefit the end users some credit or discount for buying other devices? Instead Gorilla Glass can create a distribution channel to sell their glass to end users. Glass breaking of different devices is a major challenge for end users. This approach will help Gorilla Glass to build a significant customer base by leveraging branding. With a solid customer base, it can provide credits and discounts to end users which in turn will create a network effect as OEMs will use the glass in other devices.