How can firms go from being regular product firms to becoming platform businesses? One of us first explored this question in a 2017 Harvard Business Review article, “Finding the platform in your product”. But our understanding of how this works and its nuances has significantly evolved since then. In particular, this is no longer just useful for established (large) companies attempting to boost their growth or shore up the defensibility of their products. It is also increasingly important for startups: a key part of evaluating the prospects of a startup’s product/service often lies in evaluating its potential to become a platform with network effects later on, after it has obtained product-market-fit with its core product. In fact, many successful platform businesses started off as product businesses before making the transition (e.g. Apple’s iPhone, Salesforce and Amazon Web Services, each of which we will explain in more detail below).

Why does/should everyone want to turn their product business into a platform business? Because as we talked about in our previous post, platform businesses built on network effects are the most valuable and powerful businesses around today. This doesn’t mean everyone should try to become Alibaba or Amazon, but every company should at least consider building in elements of those platforms in order to enhance growth and/or defensibility by generating network effects around its products/services. At the very least, this will be a useful exercise which might spark creativity around product innovation and business models, and a better understanding of where a given product/service business’ competitive advantage lies.

Over the next three posts, we will discuss three different methods companies can consider in order to turn their products into platforms. But before we proceed, there are a couple of important points to note:

This is not just digital transformation (e.g. replacing human-provided services by software). It is also not just about creating internal “platforms” (e.g. software modules that can be re-used in multiple products offered by the same company). Instead, consistent with our previous post on what defines platforms, turning products into platforms is fundamentally about extending those products to also enable interactions between external entities—customers and/or third parties.

The principles, methods, and tradeoffs we will discuss apply regardless of whether the product-to-platform transition was planned from day one of a startup or the platform potential emerged later on. They are also relevant to existing platforms, which may see potential to expand the number of sides they connect (e.g. Facebook was first a platform for users, then they added advertisers and app developers).

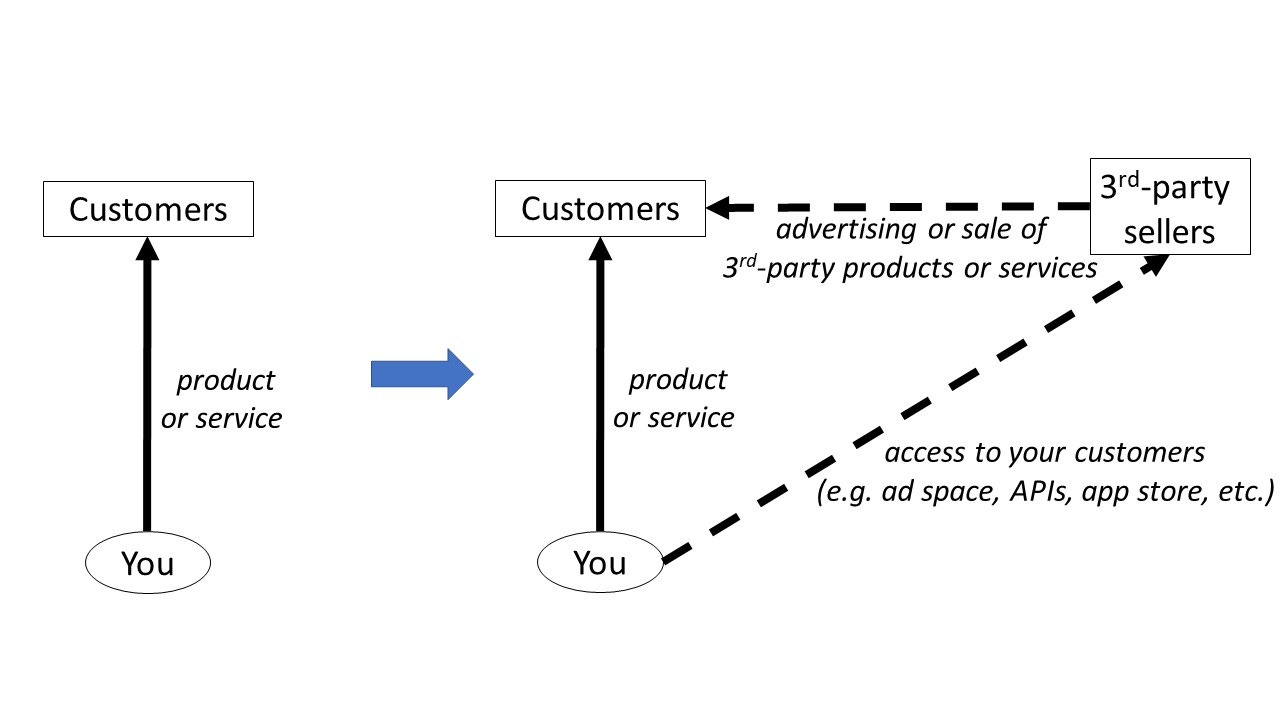

In the rest of this post, we focus on the first method for turning products into platforms: opening the door to third parties. It looks like this:

Well known examples of product businesses that have successfully opened the door to third parties:

After launching the iPhone in June 2007 as a stand-alone product running exclusively Apple-produced apps, Apple quickly realized it would benefit from the creativity of third-party developers. As a result, in July 2008 the company opened up the iPhone to third-parties (including those producing rival apps) and created the App Store.

Salesforce was founded in 1999 as a seller of CRM software products to small-to-medium-size businesses. In 2005, the company created a platform (Force.com) and an app marketplace (AppExchange) around its offering, which allows third-party software developers to build and sell other software to Salesforce’s CRM customers. Today there are over one million Force.com registered developers and over 2,500 apps offered on AppExchange.

Amazon Web Services (AWS) has been offering cloud services (e.g. database, storage and computing) since 2002, and only added a marketplace for third-party software providers to service AWS clients a decade later.

Today almost every major software firm has opened up APIs for third-party apps/services and marketplaces where customers can find and purchase those apps: Intuit’s QuickBooks, Shopify, Twilio, Wix, Zoom, etc.

And of course, the potential to open up the door to third parties exists for many earlier-stage companies, and not just pure software firms:

Peloton can open up a marketplace of third-party instructors to offer their own fitness classes to its customers in addition to the classes offered by Peloton’s own instructors.

Same goes for Calm with meditation/mindfulness practices.

Formulate is an early-stage startup that offers consumers personalized hair care products in which the chemical formula is personalized to each customer. Once the company reaches a sufficiently large customer base, it can allow third-party providers of personal care products to use its production and feedback infrastructure to test out their products and/or sell their products with different customer profiles using Formulate’s customers.

Outfit delivers a home renovation kit in a box to customers’ doorsteps, and guides them through their DIY home renovations with an app. Outfit could, in due course, develop a marketplace for users to get advice from qualified tradespeople over video, and/or for them to come in and fix up jobs when the customers have more complicated issues.

A couple of clarification points are useful (based on our experience).

First, to actually create a platform with network effects, the third parties must be granted some form of access to the company’s customers (inside or around its product). For instance, Formulate could just rent out its production infrastructure as a service to third-party sellers of personal products. That might create a nice additional revenue stream but would not turn Formulate into a platform business with network effects. To do that, the company needs to allow those third parties to advertise, test or sell their products to its customers (on its website or in the Formulate shipments to customers).

Second, although opening the door to third parties is vastly easier to do with digital products (software), it is important to realize it can be done with virtually any product/service that has a sufficiently large and attractive customer base. To drive this point home, we sometimes ask our students to propose ways in which this could work with some extremely mundane and boring products: gyms, hair salons, Coca-Cola.

So, what are the key benefits of opening the door to third parties? First, doing so increases demand for and stickiness of the core product because it now also provides access to third-party products, thereby creating network effects. Second, this can create new revenue streams if the company can monetize the third parties (e.g. charge them for access to its customers). Third, the company gives itself a chance to learn from third-party offerings, which can then be copied and incorporated into the company’s core product.

On the other hand, there are some important pitfalls to be mindful of. First, integrating with third parties can be costly: typically, this includes building integration tools and APIs, but also all the administrative costs of dealing with partners. Second, opening the door to third parties is also opening the door to headaches when the company’s customers have a bad experience with third parties they have found out about or interacted with in its product. Spoiler alert: customers might hold the company fully responsible for issues caused by third parties.

Probably the most difficult question that arises when opening the door to third parties is whether the company should allow competitors, i.e. third parties that sell products/services that are at least partial substitutes for its own products (see our academic paper “Creating Platforms by Hosting Rivals” for an in-depth analysis). In our experience, the default answer should be yes: turning competitors into complementors can be a powerful strategy for a budding platform business. Even though it loses some of the value from reduced sales of its products, its customers gain access to higher quality products/services through its core product, from which it still indirectly benefits. Furthermore, this makes customers less likely to switch to competing products. Consider what might have happened if Apple had not opened up the iPhone to third-party apps that competed with its own (e.g. Chrome browser, Facebook Messenger, Kindle, Google maps, WhatsApp). More people would likely have chosen Android phones over iPhones, which in turn would have caused more third-party app developers to focus on Android over iOS, potentially leading to winner-takes-all dynamics in favor of Android.

But of course, there should be limits and exceptions. If the third-party product in question is a close substitute to the “core” of the company’s product (e.g. an app that becomes the new operating system for the iPhone) or has the potential to become that way over time, then it’s probably not a wise commercial decision to open the doors to it.

Hosting third parties in that context would mean they develop functionalities complementary to Amazon's payment system for Amazon's payment systems' customers. This is importantly difference from licensing the payment system (presumably on a white label basis) to third parties to build their own payment system based on it.

The former would indeed allow Amazon's payment system to grow larger. The latter would just monetize it differently.

There are lots of reasons acquiring Shopify wouldn't work (antitrust is one of them). But Amazon could build their own Shopify-like product around the payment system. Interesting question is whether they would be OK to allow their merchants to sell outside Amazon.com using Amazon tools. At some point that may become the right move. The eBay and PayPal analogy works here: initially PayPal was tied to eBay but at some point it became clear that restricted PayPal's potential so they allowed it to be used outside eBay and eventually spun it off.