When pure subscription pricing makes sense for content aggregators and when it doesn’t

Suppose you have a service that offers consumers access to a variety of content from different creators (e.g. different streaming movies, different online fitness routines, or different meditation sessions). Should you sell each piece of content independently or bundle them all under one subscription? Or use a mixture of the two?

Many successful tech firms are content aggregators that rely on subscription-based business models: Calm, Masterclass, Netflix, Spotify, etc. As a result, in recent years many startups and their investors have become enamored by subscription pricing and are trying to make it work, even when sometimes it is not the best fit.

In this post we discuss the pros and cons of subscription pricing for aggregators of content, which determine when it should and should not be used.

Key benefits of pure subscription pricing

First, pure subscription pricing is simple and convenient for users. Customers pay a fixed subscription every month (or every year) in exchange for unlimited access to all available content. This affords them the peace of mind of not having to worry about which and how much content they can afford to consume.

Second, subscription pricing is effectively a form of bundling: consumers gain access to all products at a single price. This works extremely well when it reduces the variance in consumers’ willingness-to-pay across the various products. To illustrate how this works, here is a simple numerical example in which charging a single subscription price for a bundle is optimal.

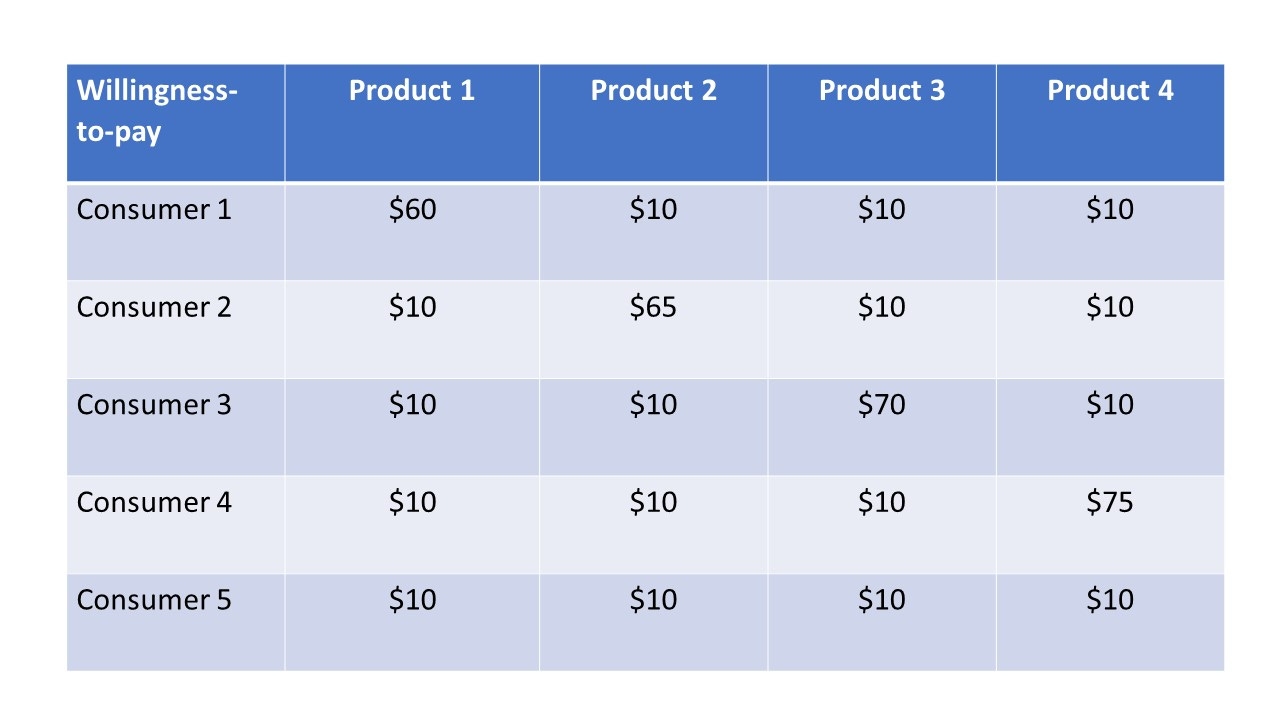

Example 1

It can be easily verified that in this situation, when products 1-4 are priced independently, the optimal prices are $60 for product 1, $65 for product 2, $70 for product 3 and $75 for product 4, so each product only gets sold to the consumer that values it the highest, and the firm’s total profit is $270. Meanwhile, when products 1-4 are sold as a bundle, the optimal price for the bundle is $90, so consumers 1-4 get all products, and the firm’s total profits is $360, which is 33% higher. And consumers are better off too: consumers 2-4 are left with a positive surplus rather than nothing. This demand scenario captures the “magic” of bundling: because consumers 1-4 have very similar total willingness-to-pay but differ in their favorite product, bundling reduces the variance in willingness-to-pay across different consumer segments and therefore allows the firm to extract a lot more value from consumers while also making consumers better off.

This is an argument that has long been understood by economists, and has more recently been popularized for entrepreneurs and investors in various blog posts such as this. While many of the examples are based on just two products that are bundled together, economists have also shown the same logic works well when a large number of different products are bundled together, as is the case for streaming services.

The bundling mechanism illustrated by our numerical example above is closely related to Shihir Mehrotra’s arguments here and here. As he explains it, bundling of content increases access to casual fans, which means consumers also benefit: with bundling, consumer segments 1-4 get access to all products, instead of one each. The logic of this example arguably applies reasonably well in the case of cable, Calm, Netflix, and Spotify. Each of these services provides access to a variety of content and different users may have very different favorite channels, meditation tracks, movies or songs. However, different users may be quite similar in their total willingness-to-pay for the entire bundle of content.

Key downsides of pure subscription pricing

The main problem with pure subscription pricing for a bundle of content is that revenue per user is fixed (by definition), irrespective of how many products each user consumes. This is particularly problematic when there is a fixed marginal cost per product. In those cases, revenue will not be able to cover cost for the most enthusiastic customers of the service, which means the business model will likely fail. MoviePass is the most spectacular example of inexplicably failing to grasp this: in exchange for a $10 monthly subscription, users could go watch a movie every day in a theater of their choosing (the ticket was bought by MoviePass at retail price), which predictably led to the company’s demise in 2019. And the same issue also plagued ClassPass early on when it was offering access to an unlimited number of fitness classes in exchange for a fixed monthly fee (the unlimited plan was later eliminated).

And even if marginal costs are zero or proportional to revenue (e.g. proportional licensing fees for Netflix and Spotify), subscription pricing is sub-optimal and leaves a lot of money on the table when user demand for variety is positively correlated with total willingness-to-pay. This is because subscription pricing (bundling) throws away the ability to charge more to users that consume more products. To illustrate this, consider the following demand scenario.

Example 2

Unlike in our first example above, here it clearly makes no sense to bundle. If the products were all bundled, the optimal price for the bundle would be either $20 or $30, resulting in total profits of $60 either way. Instead, each product should be sold independently (a la carte) at $10, resulting in a total profit of $100. Any bundling (of two or more products) would do worse than this. The key is that here a consumer that is interested in more products has a higher total willingness-to-pay, so there is perfect correlation between demand for variety and willingness-to-pay, which means selling a bundle of content under a subscription is inefficient.

To further emphasize the importance of the positive correlation between demand for content variety and total willingness-to-pay, suppose instead the configuration was like this:

Example 3

Here, the correlation between demand for variety and total willingness-to-pay is gone (the consumers that are interested in fewer products value each of them more), so bundling actually makes sense once again: $40 for all 4 products, yielding $160 in total profits. Independent pricing would make at most $105.

Obviously, real-world scenarios are more complicated than these simple numerical examples and possibly combine aspects of each. For instance, some Spotify users may love listening to the same songs or playlists over and over again, whereas others may prefer to always explore and discover new artists and songs. And at the same time, it is also possible that total willingness-to-pay for the service is positively (though not perfectly) correlated with the number of songs a user is interested in. This positive correlation seems even more plausible in the case of Netflix: users who watch more movies and shows are likely willing to pay more for the service than users who watch less content. Yet Netflix maintains a pure subscription model, likely because it believes the simplicity and convenience benefits mentioned above are more important.

The second (and related) big issue with offering a bundle of content under a pure subscription price is that it cannot sufficiently reward or incentivize superstar creators.

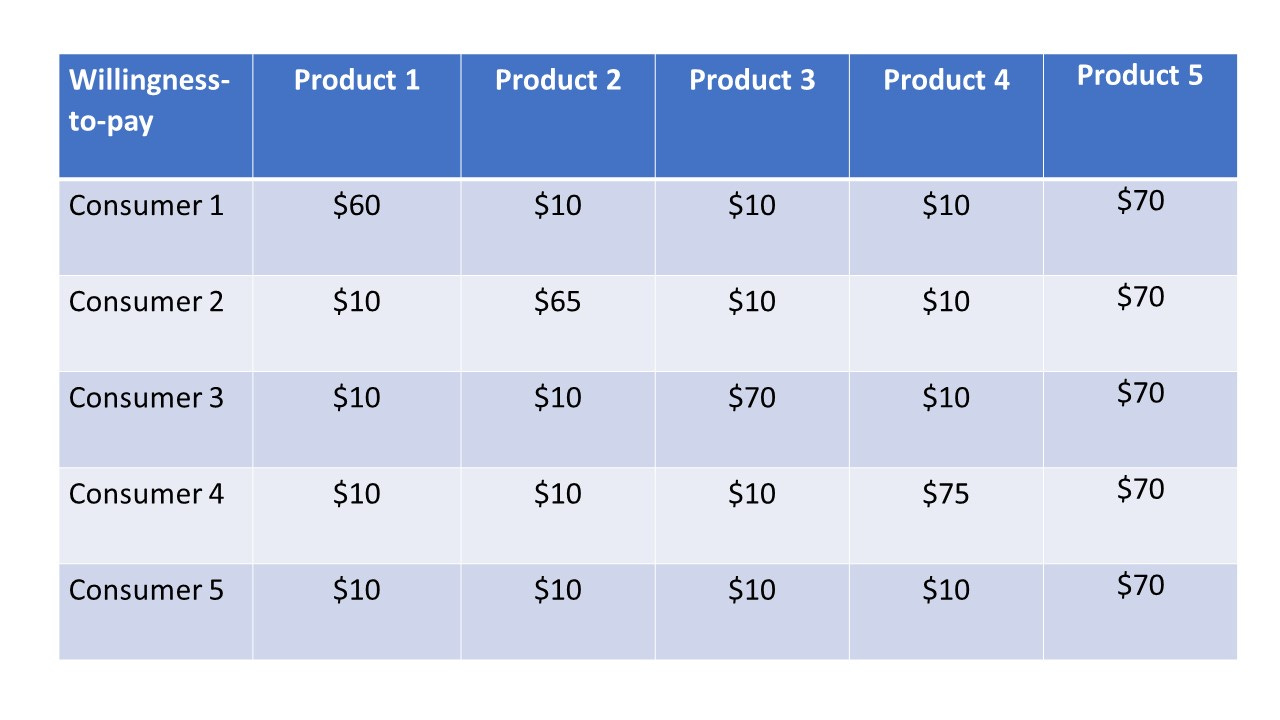

To see this clearly, consider the following scenario.

Example 4

This is just like our first numerical example above, except we added “superstar” product 5, which everyone values at $70. It is easily seen that product 5 should not be sold as part of any bundle, but rather priced independently at $70 (products 1-4 should still be bundled for $90). The reason is that if product 5 were sold as part of a bundle, consumer 5 would not get access to it. Indeed, to ensure consumer 5 can access product 5 under bundling (subscription) would require selling the bundle for $110, which would generate $550 of profit, as opposed to the optimal bundle price of $160, which generates $640 in profit.

So even if the firm were to pay the product 5 supplier the entire value created by product 5, under bundling it would only be able to pay $280, as opposed to the $350 that product 5 can yield by being sold independently.

The key point here is that offering a bundle of content under a pure subscription model makes it difficult to sufficiently reward “superstar” content (that many users want) and its creators. For example, this is why HBO and UFC fights are typically not included in the cable bundle and must be purchased separately. Similarly, this is also why online videogame stores associated with the latest consoles (PlayStation 5 Store, Nintendo Switch Games Store) leave the most popular games outside of their subscription plans. And this also explains why Netflix cannot afford to offer any recent hit movies (that it has not produced itself) through its service: the studios who produced those movies charge licensing fees that would quickly overwhelm the monthly subscription fee charged by Netflix to its users. For instance, right now in the US, Godzilla vs. Kong is available for $6 as a rental or $20 as a purchase on Amazon Video, whereas Netflix’s standard subscription price is $14/month. This comparison also shows how a mixed pricing model, with subscription (bundle) for a baseline library of content plus a la carte pricing for hit content (as is the case with Amazon Video), can be better than a pure subscription model (Netflix).

One may counter that firms can split the subscription revenue among their creators in proportion to the usage of their content, so more popular creators get paid more. This practice is used by Spotify and has also been implemented by some recent startups. For example, Playbook provides access to a bundle of workouts designed by “more than 100 trainers and athletes” in exchange for a single subscription fee of $15/month or $100/year. In an effort to incentivize popular trainers to bring their existing customers or social media followers to the platform, Playbook even lets every trainer keep 80% of the subscription revenue from users who sign up via the direct link provided by the trainer. These subscribers still get the benefit of accessing all available fitness content on Playbook. Still, it is important to realize this does not fully solve the problem because the subscription price remains the same for all consumers, and so superstars may not be able to extract the full value they offer, as illustrated in numerical examples 2 and 4 above.

This is particularly problematic when motivating creators to provide great content is very important, as is the case with many platform businesses. If the content already exists and it’s just a matter of distributing it through an additional channel, then not much is lost in terms of incentives by bundling and sharing revenues on the back-end in proportion to usage (e.g. Spotify). But if creators need to be constantly incentivized to produce new high-quality content, then it may be better to let them sell their content independently (a la carte) so that more popular creators can reap a bigger portion of the marginal value they create. This is why the pure subscription pricing model is not a good fit for platform businesses in the long run, given that they are all about giving control over pricing (and other decisions) to the supply side. If Playbook, which pitches itself as the “#1 platform for health & wellness creators” (and their fans) really wants to live up to its platform potential and attract superstar trainers, it will need to consider moving away from the pure subscription model by giving creators more control over their pricing.

Conclusion

If there is a large ongoing cost associated with additional content consumption, then bundling content under a pure subscription pricing model is doomed from day one. If there is a significant positive correlation between user demand for variety and total willingness-to-pay for the service, or if most of the content is supplied by “superstar” providers that need to be appropriately incentivized, then adopting a pure subscription model is also a bad idea.

On the other hand, if costs don’t overwhelm fixed subscription revenue per user and if few content creators have strong bargaining power, then firms can start with pure subscription pricing in order to make things as simple and as convenient as possible for users. Later on, they can move to a mixed pricing model of subscription plus a la carte prices for highly popular (or valuable) content. Indeed, as services that started off with pure subscription pricing add more content (e.g. Calm and Netflix), the revenue limitations of the subscription model will become clearer and more pressing, especially once subscriber growth slows down. Once the service runs out of room to grow by adding new subscribers at a fast-enough rate, it makes sense to unlock revenue growth opportunities per subscriber by at least adding some a la carte elements.

Really interesting piece, I thought the Playbook example was a great way to incentivise creators. What happens when between the platform that charges for the sub, and the creator, there is another layer - I am thinking scribd etc. Is there a good example where the charging and paying model is very good and working really well for both the content provider (middle) and the creator?

Great article, I especially appreciate the math models. I run a subscription service and I dig this big time. Two thumbs up!