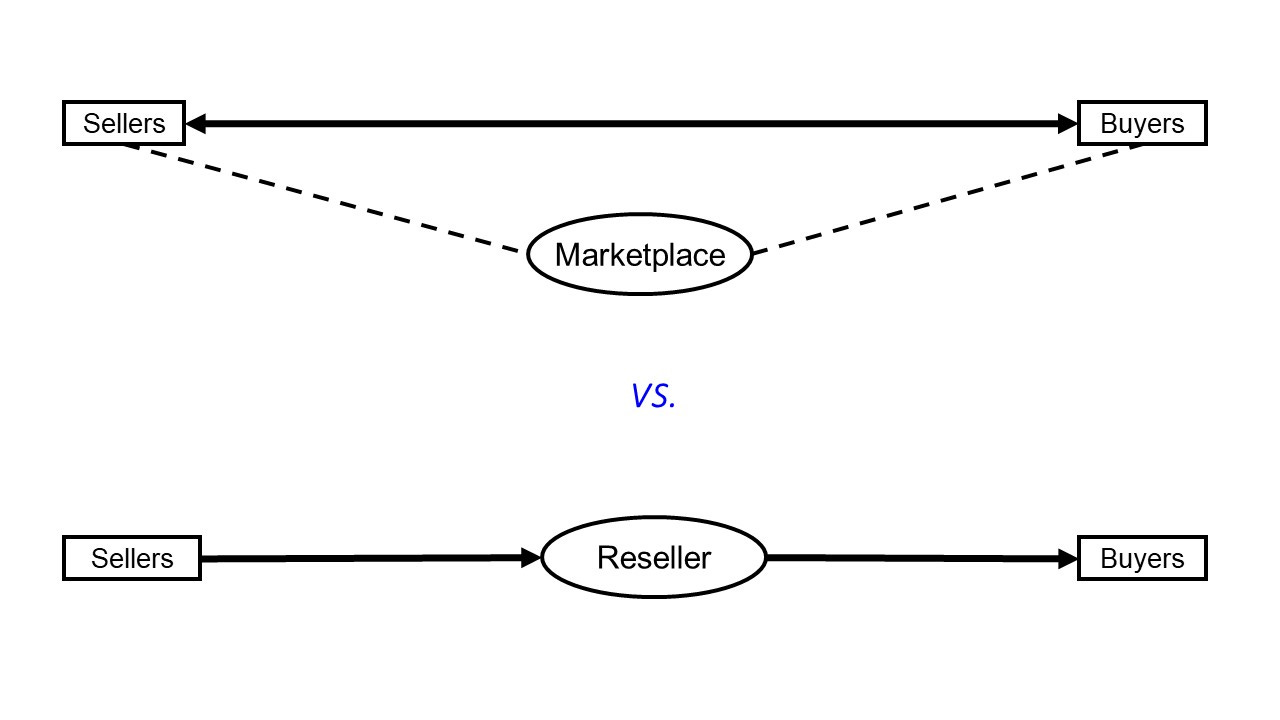

Many start-ups that wish to serve as intermediaries between buyers and sellers must choose where to position themselves along the continuum between a pure marketplace (e.g. Craigslist, eBay) and a pure reseller (e.g. Zappos, Netflix). In this post, we discuss the fundamental factors that should determine this strategic choice.

The control continuum

As we explained in our post on what defines platform businesses, there is a continuum between pure marketplaces (e.g. Craigslist, eBay), which enable independent sellers to directly sell their products/services to buyers, and pure resellers (e.g. Zappos, 7-Eleven), which buy the products from sellers and then resell them to buyers.

The continuum is defined by how much control is taken by the intermediary over key aspects of the corresponding transactions: pricing, marketing, order fulfilment, customer service, etc. This continuum exists both for products

and for services

Department stores like Macy’s are in the middle because they sell some products (e.g. kitchenware, clothing) in their own name, while allowing independent brands to set up counters that they design and control for selling other products (e.g. cosmetics). Similarly, Amazon is in the middle (and increasingly moving towards the marketplace end of the spectrum based on number of products): it sells some products in its own name, alongside products sold on terms controlled by third-party sellers. Meanwhile, Uber is in the middle because it controls certain aspects of the driver-rider interactions (price and choice of whom to serve) while allowing drivers to control other aspects (choice of car, work schedule).

The marketplace-reseller continuum creates a fundamental tradeoff for companies. Moving towards the pure marketplace end of the spectrum makes businesses more scalable since they don’t have to incur the costs associated with taking ownership of and responsibility for products/services and their delivery. On the other hand, moving towards the reseller end of the spectrum incurs higher capital and operational costs, but the higher degree of control affords the ability to offer a better customer experience – for buyers, or sellers, or both.

Choosing the optimal position on the control continuum

Given this fundamental tradeoff between cost and control, there are several factors that can push the optimal choice of positioning on the marketplace-reseller continuum one way or the other.

1. Information

The first factor is, which party, the independent suppliers or the intermediary, has better information about how best to set the relevant decision variables like prices and other marketing activities. Given contracts are rarely perfect or complete, it matters who gets to make these decisions, and more value can be created if the control is given to the party with the better information. This is a key reason why all successful ride sharing companies (Didi, Grab, Lyft, Uber) set the prices of the rides they enable, whereas on freelancer marketplaces like Fiverr, Task Rabbit and Upwork, prices are set by the independent sellers. This is also why department stores have traditionally offered cosmetics through dedicated “counters” where displays are designed and controlled by individual brands (and sales staff are assigned exclusively to and trained by specific brands), whereas many other more standard products are offered on displays controlled by the department store and serviced by generalist sales personnel. It reflects that cosmetics brands have highly specialized knowledge about how best to market specific products to consumers, which is hard for stores and their sales staff to accumulate. This principle also guided Amazon’s expansion from an online book reseller to “the everything store”. Since it didn’t have expertise in selling much more than books initially, when it wanted to expand into electronics, it relied on third-party sellers who were better placed to decide what to stock, how to price and how best to market products.

2. Value of a better buyer/seller experience

As mentioned earlier, the higher degree of control associated with moving towards the reseller end of the continuum is associated with higher costs (so less scalability), but at the same time allows the intermediary to optimize the experience for buyers or sellers or both. This usually means faster, more consistent and reliable service. The key question is then just how much more valuable is that superior experience in the eyes of buyers and/or sellers. In some cases, it can create significant additional willingness-to-pay and customer loyalty, making the reseller model more appropriate.

As an example, it is useful to remember Zappos started off in 1999 as an online marketplace for shoes, where products were priced and fulfilled by third-party sellers/brands. However, after realizing that under this model it could not guarantee a consistent experience to its buyers, the company turned itself into a pure reseller by 2002, stocking inventory and taking full control of transactions with buyers. This allowed Zappos to offer its buyers unparalleled customer service, which eventually became the company’s key source of competitive advantage.

In other contexts, however, being closer to a pure marketplace does not entail a big downside in terms of the experience perceived by buyers and sellers, but a significant upside in terms of scalability. For instance, Etsy could certainly offer better services to both its buyers and sellers of arts and crafts, by moving towards the reseller model, but the added value in terms of convenience to both sides would be quite limited (unlike the case of Zappos). Meanwhile, the reseller model would be prohibitively costly in this case.

Many companies today try to strike a balance between scalability and very good customer experience by choosing a position somewhere in the middle of the continuum, which VCs and founders call “managed marketplaces”. We mentioned Uber above, which controls the price and matching of riders with drivers. As another example, marketplaces in the pre-owned luxury fashion industry like StyleTribute, TheRealReal, and Vestiaire Collective are typically highly managed. They authenticate the items being sold by third-party sellers, the way they are marketed, the way they are boxed and shipped, and the returns policy, so although they don’t set the price or take ownership of the items (they are normally sold on consignment), they handle almost everything else.

3. Long-tail vs short-tail products

High-demand (short-tail) products are sold more efficiently by one large reseller than by many small sellers. The reseller can capitalize on economies of scale in purchasing, infrastructure investments (in warehouses and distribution centers, for example), delivery, customer support, and so on. These advantages, however, don’t apply so much to low-demand—or “long-tail”—products. This is why, in general, marketplaces work best for long-tail products or services – think eBay, Etsy, and TaskRabbit.

And this is why Amazon (who has the ability to act as either a marketplace or a reseller for any given product) mostly chooses the reseller mode for high-demand products (e.g. electronic accessories and gadgets, daily household supplies), while mostly acting as a marketplace for long-tail products (e.g. inflatable sloth floats or mobile phone jail cells), leaving them to independent sellers.

4. Cross-product spillovers

The fourth factor which determines an intermediary’s positioning between marketplace and reseller is the presence of demand interdependencies across products. If marketing, pricing, or other types of decisions for one product generate strong effects on other products (i.e. there are spillovers), the reseller mode becomes more attractive compared to the marketplace mode. This is because a reseller can more easily internalize these externalities when it is making its pricing and other marketing decisions. This can help explain why cable TV operators and Netflix predominately choose to operate in the reseller mode, extracting more value by bundling and cross marketing different channels or different shows/movies.

5. Overcoming the cold start problem

The biggest hurdle faced by any marketplace in its early days is overcoming the chicken-and-egg problem of attracting both buyers and sellers, when it does not have critical mass of either. A natural way to solve this chicken-and-egg problem is to start in reseller mode, buying products from sellers and reselling them to buyers, thus ensuring there will be an adequate range of supply from the start. Once enough buyers participate, the intermediary can switch to the marketplace mode. There are several examples of firms that have used this playbook. Amazon started as a reseller of books, before it had enough customers that it could invite third-party suppliers to sell their products. Similarly, Uber initially hired drivers to drive around specific areas in exchange for fixed hourly rates in order to generate enough demand, before it transitioned to drivers as independent contractors, paid per ride.

Concluding thoughts

At a high level, marketplaces are volume businesses: the goal is to enable as many transactions as possible. Meanwhile, resellers are arbitrage businesses: the goal is to find products or services that can be sold at a significantly higher price than what they can be bought or provided for. The arbitrage opportunity comes from one or several of the factors described above.

It is rare that all factors point in the same direction, i.e. either pure marketplace or pure reseller, so the optimal position is usually somewhere in the middle, leveraging the advantages of both modes. This explains why there are few if any pure, bare-bones marketplaces today (like Craigslist): all modern marketplaces are managed to a certain extent, because they found ways to profitably offer valued added services to one or both sides.

Finally, it is important to note that in some markets, companies may find success with different positions on the marketplace-reseller continuum, by appealing to different segments of buyers and/or sellers. In other words, there isn’t necessarily a unique “peak” position in a given market (e.g. eBay vs. Amazon vs. Zappos, Opendoor vs. Redfin vs. Zillow, Cars.com vs. Carvana). In particular, the optimal positioning for a startup entering the market should take into account where incumbents are located on the continuum – sometimes it may be better to focus on the space left by others.

Clear and with lots of useful information. As an e-commerce founder, I have often been asked why I use the reseller mode and not the pure marketplace mode. This is why!